A Review of AI Forecasting Results: 83% winning rate across 800 China A-share companies

2021-05-20 15:43:42

As all China A-share listed companies published their annual reports, the accuracy of the corresponding forecasts made by various institutions became apparent. Technology empowered investment, a new highlight of the market, has attracted a lot of attention. The accuracy of Datayes’ AI forecast has outperformed analyst consensus in 83% of 800 China A-share companies.

In 2020, economic turbulence, black swan and gray rhino events in the A-share market, and the resulting poor revenue of many listed companies have made revenue forecasting a lot harder than in previous years.

Given this complex market environment, investment institutions have harnessed their strengths, and adopted various approaches to forecast the revenue of listed companies. Datayes launched a new forecasting model by leveraging big data, AI and other technologies.

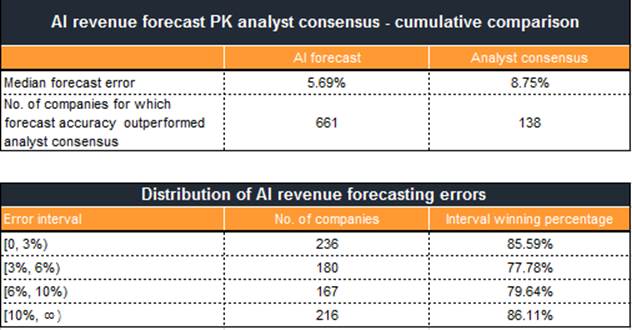

The results showed that of the forecasts of 800 major China A-share companies, AI forecasting had a winning rate of 83% compared to analyst consensus, with a median forecast error of 5.69%; its forecasting accuracy was well ahead of analyst consensus.

Accuracy of AI forecasting

The AI forecasting code

The fundamental and quantitative approaches are two major models used in investing, and some investment institutions are actively exploring a combination of the two. In recent years, ‘Quantamental’ has been all the rage on Wall Street.

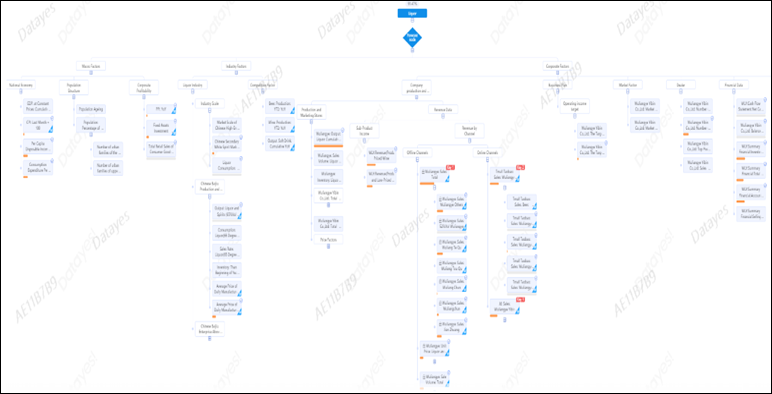

Datayes was the first to advocate Quantamental in China, and human-machine AI forecasting is an exploration of this new model. AI forecasting is a combination of professional knowledge and cutting-edge technology. Starting with fundamental investment research rationale, and based on knowledge graphs, a research framework for each stock is constructed. On the basis of mining financial big data, it harnesses the advantages of machines to mine the correlation between data and fundamentals, and incorporates the drivers into the financial quantitative model, thus creating a sophisticated human-machine integrated investment system.

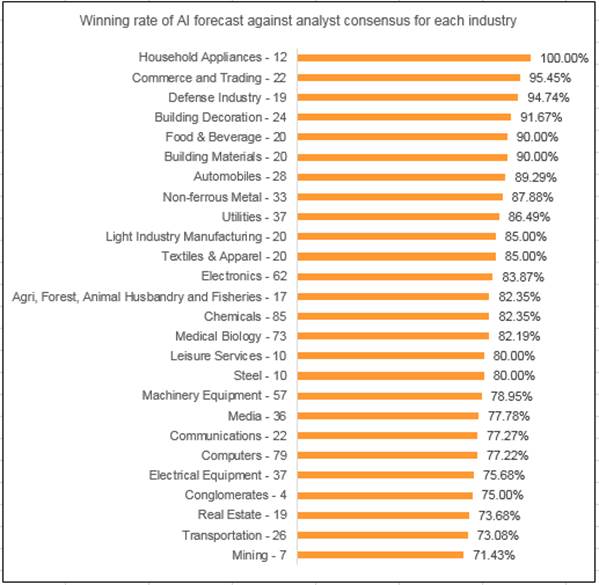

Of the 800 samples, AI forecasting outperformed significantly in industries such as household appliances, commerce and trading, defense industry, building decoration, food & beverage, building materials, automobiles, non-ferrous metals, and utilities.

Over the years, Datayes has amassed data at home and abroad from 18 major traditional financial databases and nine alternative databases in various fields including finance, industry, enterprise, search engines and media, which strongly supports fundamental investment research. High frequency updates have also provided a more reliable basis for the forecasting model. In terms of accuracy, industries with ample high frequency data and featured data have significant forecasting accuracy advantages.

Value of the new model

Thanks to ongoing innovations in the field of intelligent investment research, Datayes has achieved major breakthroughs in this human-machine investment model in terms of breadth of coverage and depth of research.

In general, the scope of research an analyst conducts on a company includes industry background and trends, evolution of the company’s development, principal business activities and products, financial condition, and forecasting development over the next few years, among others. Given limited human capacity, an analyst would track 30 to 40 companies at most. In contrast, continuous machine learning and manual optimization have meant that AI forecasting can cover all the listed companies in the market. This has significant asset allocation implications for major funds which can use this model to mine investment targets from the entire market.

As the research framework is based on the professional knowledge of analysts, the model has strong interpretability. Meanwhile, the research framework, backed by knowledge graphs of greater breadth, can effectively expand on and develop the thinking of analysts to capture dark horse indicators neglected by analysts.

Datayes – Wuliangye’s revenue forecast model (partial display)

The forecasting accuracy of this new integrated human-machine method has continued to improve. In the 2019 annual report earnings forecast test, AI forecasts beat analyst consensus by a winning rate of 82.5%. In the 2020 annual report forecast, the winning rate rose to 83% despite the occurrence of black swan and gray rhino events, fully reflecting the development potential of AI forecasting.

It was mentioned in the book, The Singularity Is Near: When Humans Transcend Biology that the human race will enter a phase of particularly rapid technological development, i.e., singularity, by 2045. More significant breakthroughs in forecasting and cognitive methods in the financial sector will accompany the advent of singularity and technological breakthroughs. Datayes will be more than happy to usher in the arrival of this era with you.