A Machine Learning-Based Corporate Bond Rating Model

2021-10-20 15:42:21

1. Abstract

As an advanced machine learning model based on the fundamental data and operational data of bond issuers and the complete and self-consistent quantitative fundamental logic, the Datayes! corporate bond rating model is constructed to forecast the default risk of bond issuers while rating them. At the same time, it can perform attribution analysis on the rating results and reach a balance on accuracy and interpretability of the model.

2. Model Overview

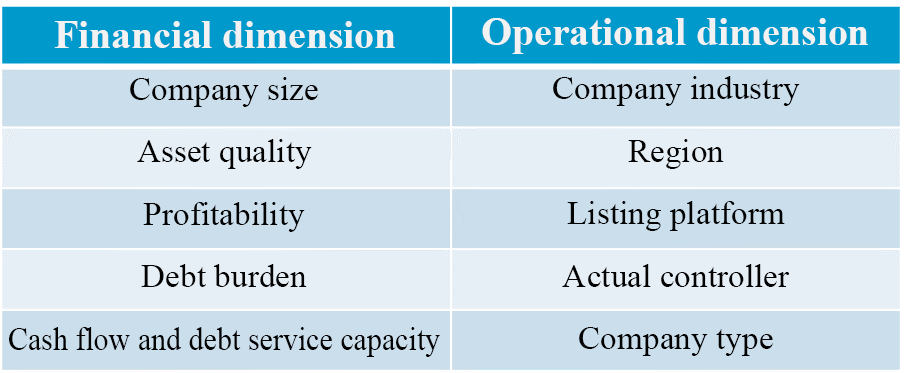

2.1. Feature dimensions

Datayes! uses the fundamental financial data and key operational data of corporate bond issuers as the original input, experts’ prior knowledge as guidance, and feature engineering as the technical means to generate the input features for model training through “human-machine cooperation”. The features include the following dimensions:

2.2. Forecast model

The forecast of defaulting issuers and negative news is a typical task involving learning from imbalanced data and cost-sensitive learning. Learning from imbalanced data is used when defaulting issuers account for a small percentage; and cost-sensitive learning indicates that misclassifying issuers with a high probability of default as issuers with a low probability of default costs much more than misclassifying issuers with a low probability of default as issuers with a high probability of default. Based on pre-processing operations such as feature engineering, Datayes! runs an advanced machine learning model to forecast the probability of default and negative news for each issuer, significantly improving the forecast accuracy and stability.

2.3. Interpretable model

In order to ensure the interpretability of the model, Datayes! leverages an interpretable model to generate quantitative interpretations by performing high-fidelity approximations to the forecast model. Then, based on the investment research logic in line with human experts’ prior knowledge, the approximation results are attributed to present qualitative interpretations. The qualitative and quantitative interpretations are combined to achieve the goal of “knowing both the truth and the cause”.

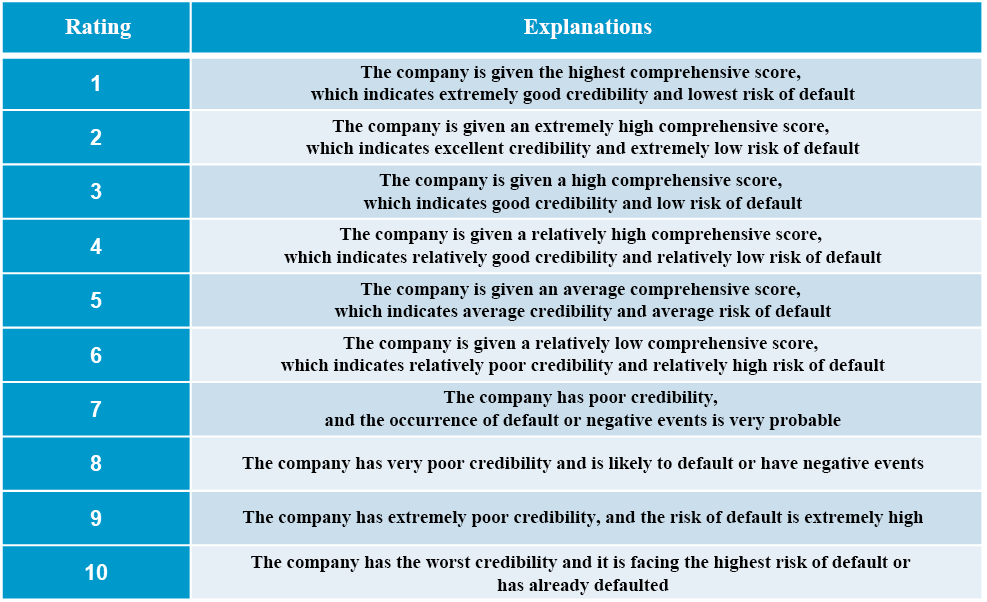

2.4. Explanation of rating

The Datayes! corporate bond rating model divides bond issuers into ten levels from 1 to 10. The higher the level, the poorer the credibility of the issuer and the higher the probability of default. Issuers rated ≥ Level 7 are those that are likely to default or have a negative incident forecasted by the model. Each level is specifically described in the figure below:

3. Analysis and Discussion

3.1. Forecast accuracy analysis

3.1.1 Defaulting issuer forecast

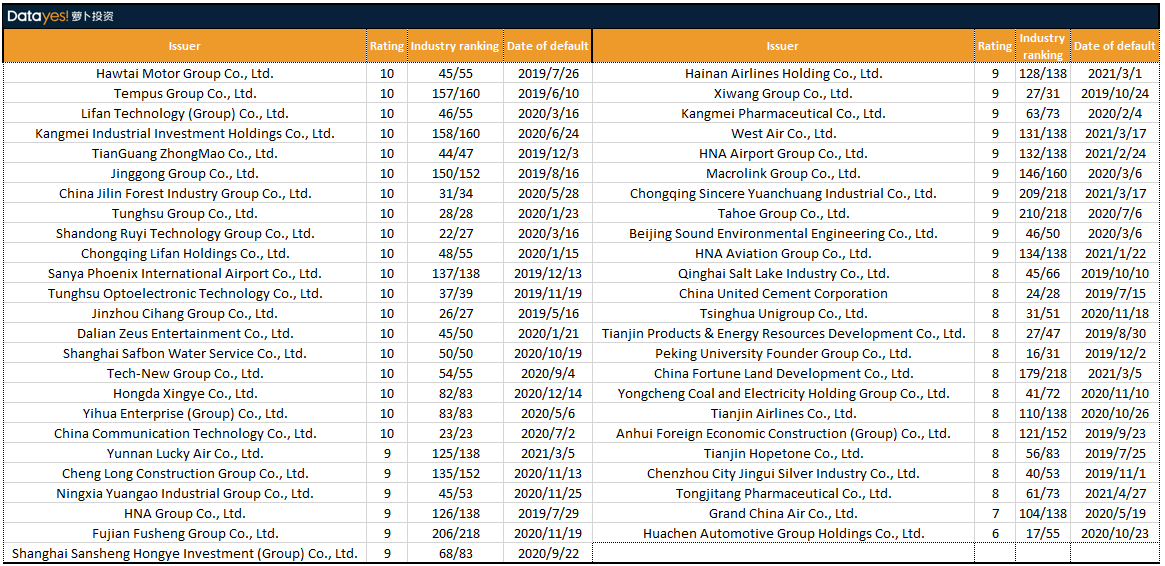

To verify the model’s ability to forecast defaulting issuers, two time points, 2019-04-30 and 2020-04-30, were chosen as forecast dates to evaluate the model’s forecast accuracy. Figure 1 shows the rating results, between 2019-04-30 and 2021-04-30, of a total of 49 bond issuers that defaulted for the first time on the forecast date (2019-04-30). The model successfully forecasted 48 of them (rated ≥ Level 7), achieving a hit rate of 98%.

Figure 2 shows the rating results, between 2020-04-30 and 2021-08-30, of a total of 25 bond issuers that defaulted for the first time on the forecast date (2020-04-30). The model successfully forecasted 24 of them (rated ≥ Level 7), achieving a hit rate of 96%.

The comparison shows that the model is capable of giving advance warning for more than 95% of the defaulting issuers, and for most of them, the model gave the warning early enough before the default event, providing investors with sufficient preparation time.

Figure 1 Between the Forecast Date and 2021-04-30, Rating Results of the Bond Issuers That Defaulted for the First Time on the Forecast Date (2019-04-30)

Figure 2 Between the Forecast Date and 2021-08-30, Rating Results of the Bond Issuers That Defaulted for the First Time on the Forecast Date (2020-04-30)

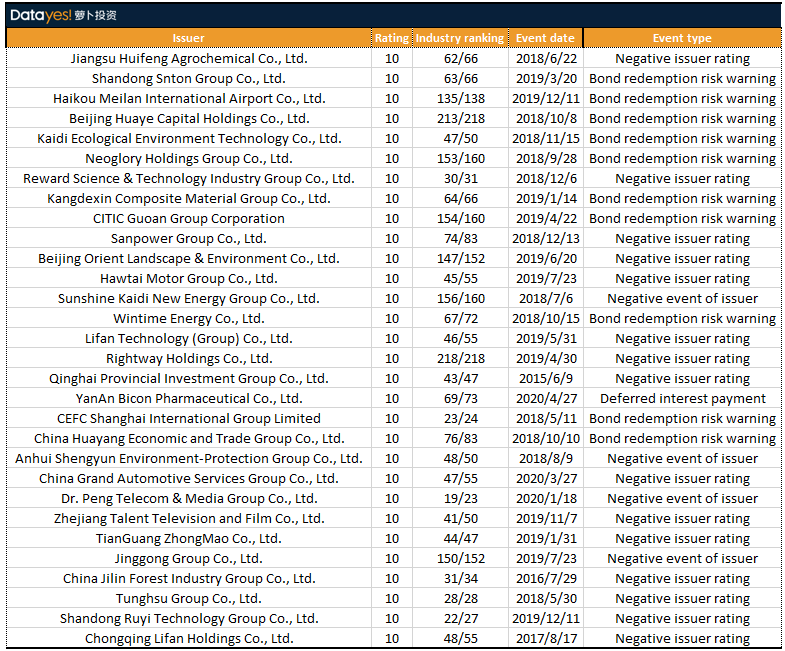

3.1.2 Negative event forecast

In addition to default events, if any negative event such as rating downgrades, redemption risk warnings, or negative ratings happen to a bond issuer, the credit spread of the corresponding bond will widen significantly, which will negatively affect the investment decision and expected return of bond investors. The following verified whether the model has the ability to forecast the occurrence of negative events to the issuers.

Within one year after the forecast date (2019-04-30), a total of 112 bond issuers in the samples had negative events other than defaults. The model successfully forecasted 100 of them (rated ≥ Level 7), achieving a hit rate of up to 89%. Figure 3 shows the rating results of the corresponding issuers on the forecast date (2019-04-30).

Within one year after the forecast date (2020-04-30), a total of 143 bond issuers in the samples had negative events other than defaults. The model successfully forecasted 109 of them (rated ≥ Level 7), achieving a hit rate of up to 76%. Figure 4 shows the rating results of the corresponding issuers on the forecast date (2020-04-30).

The results show that the model is able to provide prior warning for more than 75% of the issuers that would have negative events happen to them, greatly reducing the probability of investors stepping on a landmine.

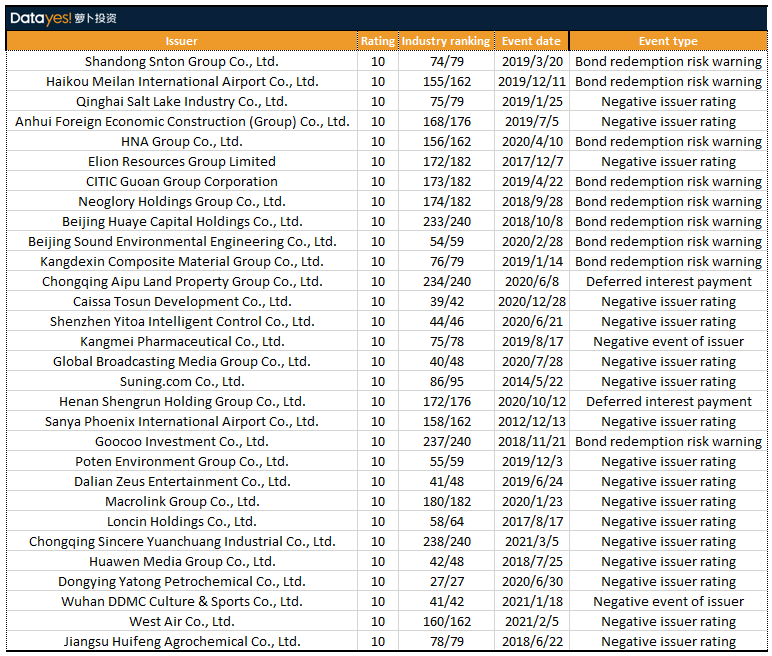

Figure 3 Rating Results of Some Issuers That Had Negative Events Within One Year After the Forecast Date (2019-04-30)

Figure 4 Rating Results of Some Issuers That Had Negative Events Within One Year After the Forecast Date (2020-04-30)

3.2. Model output and case analysis

To illustrate the effectiveness and advancement of the model, and the rationality of the attribution results, the following case studies were conducted on representative defaulting bond issuers based on the model output.

3.2.1. Yongcheng Coal and Electricity

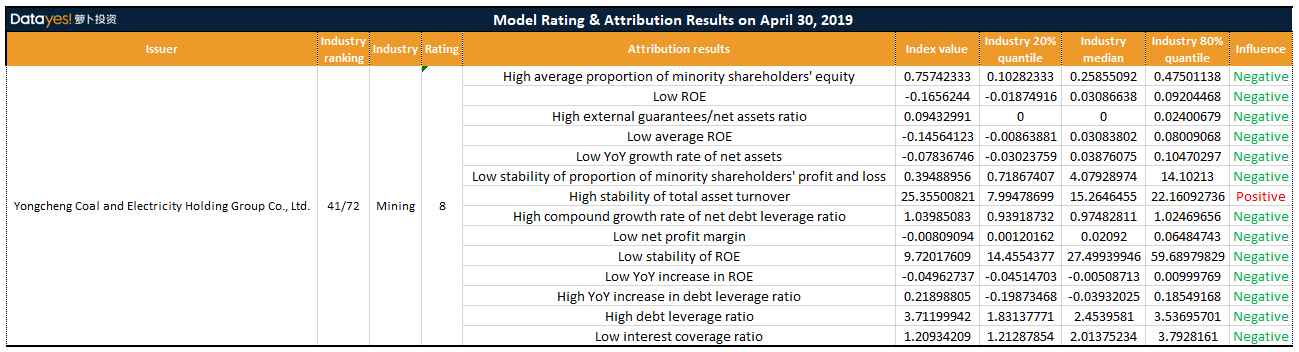

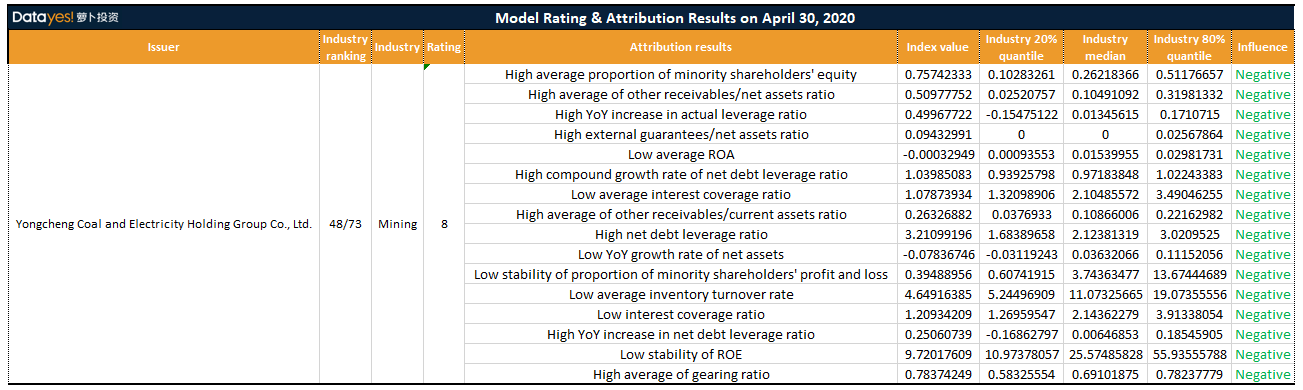

Yongcheng Coal and Electricity Holding Group Co., Ltd. (“Yongcheng Coal and Electricity”) is a local state-owned enterprise and a wholly-owned subsidiary established by Henan Coal Chemical Industry Group Co., Ltd. with the state-owned net assets held in Yongcheng Coal and Electricity Group Co., Ltd. equaling CNY 3.4 billion. Yongcheng Coal and Electricity announced on November 10, 2020 that due to liquidity constraints, it failed to make full payment of principal and interest as scheduled for the bond “20 Yongmei SCP003”, which constituted a substantial default. The overdue principal amount was CNY 1 billion, and the overdue interest was CNY 32 million. Yongcheng Coal and Electricity’s default shocked the long-standing belief in state-owned enterprises in the credit bond market that they are “too big to fail”. However, the forecast results of the Datayes! corporate bond rating model revealed that the model had rated Yongcheng Coal and Electricity at Level 8 as early as April 30, 2019, indicating that it had a high probability of default. In the forecast result of April 30, 2020, although Yongcheng Coal and Electricity’s rating remained at Level 8, its ranking in the industry had declined compared with the same period last year, indicating that the model believed that it had a greater risk of default than last year.

From the attribution results, it can be analyzed that Yongcheng Coal and Electricity has a high gearing ratio and a high compound growth rate of debt leverage, which combine to produce a great debt service pressure. The high average proportion of minority shareholders’ equity indicates that the company’s equity is dispersed. Meanwhile, the low ROA and ROE indicate the company’s serious lack of profitability, which is compounded by the accompanying weak debt collection. In addition, considering that the company’s external guarantees account for a large proportion of its total assets while its interest coverage ratio is low, the company can be found to be in an embarrassing situation that it is overwhelmed by debts and potentially huge guarantee claims. A series of negative factors explained the model’s rating, and the subsequent default of Yongcheng Coal and Electricity also verified the accuracy and rationality of the model’s prior rating and attribution.

Figure 5 Rating & Attribution Results of Yongcheng Coal and Electricity on April 30, 2019

Figure 6 Rating & Attribution Results of Yongcheng Coal and Electricity on April 30, 2020

3.2.2. Tahoe Group

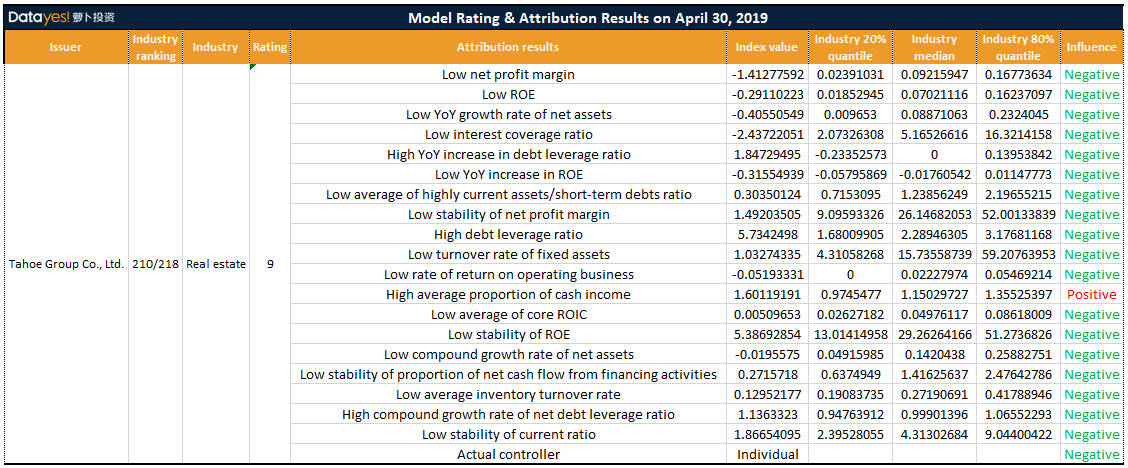

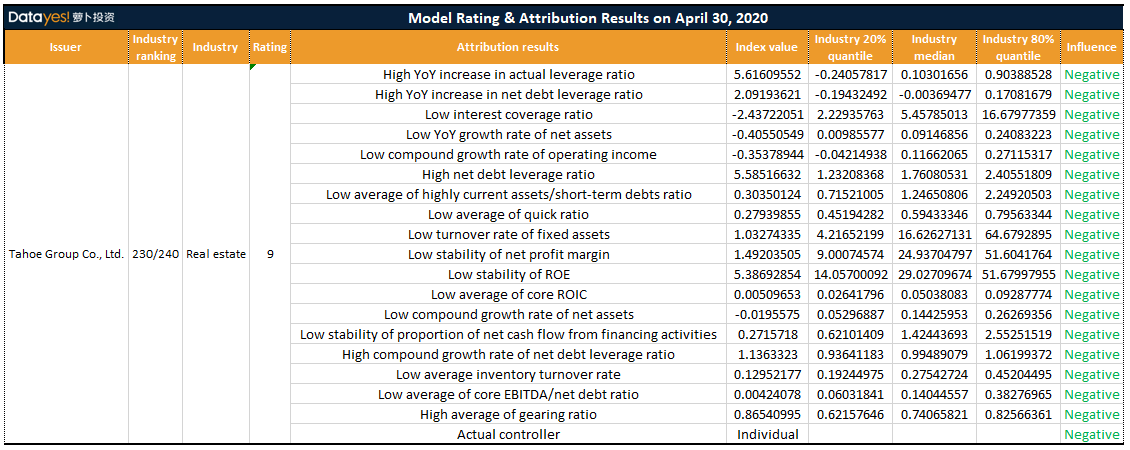

On July 6, 2020, Tahoe Group Co., Ltd. (“Tahoe Group”) announced that due to the decline in the company’s project selling rate and fluctuations in sales expectations, compounded by the company’s large debt size, high financing costs, and concentration of due debt payments, the company suffered short-term liquidity difficulties, and the balance of actual defaulted bonds amounted to CNY 8.916 billion. Tahoe Group also became the first company out of the Top 50 real estate companies to default, which destroyed the belief that leading real estate companies will not default. The forecast results of the Datayes! corporate bond rating model revealed that the model rated Tahoe Group at Level 9 on April 30, 2019 and still believed that Tahoe Group’s operating conditions had not improved as of April 30, 2020, thus keeping its Level 9 rating, indicating that the entity faced an extremely high risk of default.

From the attribution results of the model, it can be further seen that Tahoe Group’s highly liquid current assets can barely cover its short-term debts. The quick ratio and interest coverage ratio are also low, foretelling that the entity was under huge short-term debt service pressure. The low ROE and ROIC show the entity’s lack of profitability, compounded by the low stability of the proportion of net cash flow from financing activities, further indicating the gradual deterioration of the entity’s external financing environment. Coupled with the fact that the actual controller of the company is an individual whose credibility is low, such a series of negative factors paved the way for the subsequent default.

Figure 7 Rating & Attribution Results of Tahoe Group on April 30, 2019

Figure 8 Rating & Attribution Results of Tahoe Group on April 30, 2020

3.2.3. Languang Development

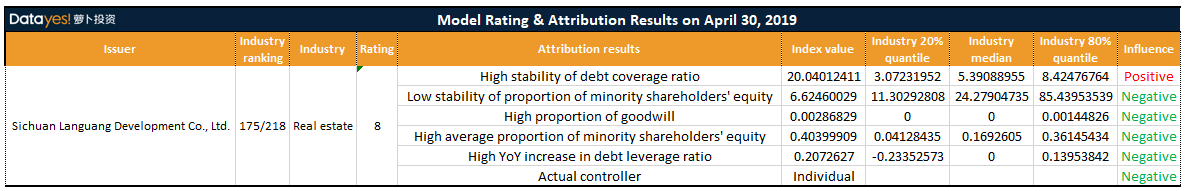

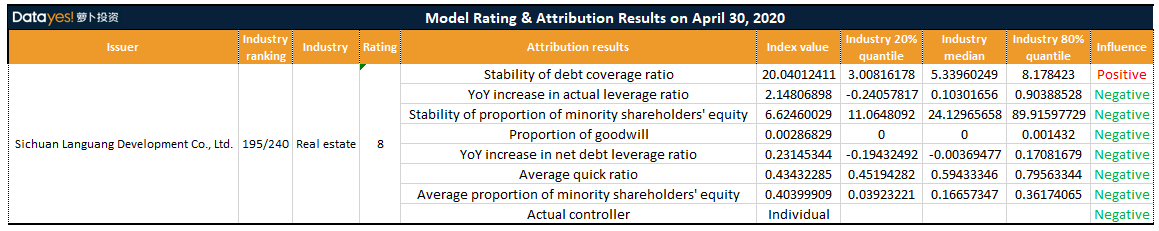

On July 12, 2021, Sichuan Languang Development Co., Ltd (“Languang” or “Languang Development”) announced that the bond “19 Languang MTN001” was due for principal and interest payment on July 11, 2021, but Languang failed to raise sufficient funds for payment as agreed by the end of the due date and had therefore constituted a substantial default.

The forecast results of the Datayes! corporate bond rating model revealed that the model had rated Languang at Level 8 as early as April 30, 2020, indicating that it has a high risk of default. On April 30, 2021, Languang’s rating remained at Level 8, indicating that it had not reversed its operating difficulties and still had a high risk of default. The attribution results given by the model show that despite the high stability of the company’s debt coverage ratio, its short-term debt service capacity had been actually inadequate for a long time. Languang’s asset quality is poor due to the high proportion of goodwill in its assets. Meanwhile, the company’s financial policy is extremely unstable, with a large increase in actual leverage. In addition, the company’s actual controller is an individual, resulting in a high degree of uncertainty about its debt repayment ability. The aforementioned negative factors also planted the seeds of Languang’s subsequent debt default.

Figure 9 Rating & Attribution Results of Languang on April 30, 2019

Figure 10 Rating & Attribution Results of Languang on April 30, 2020

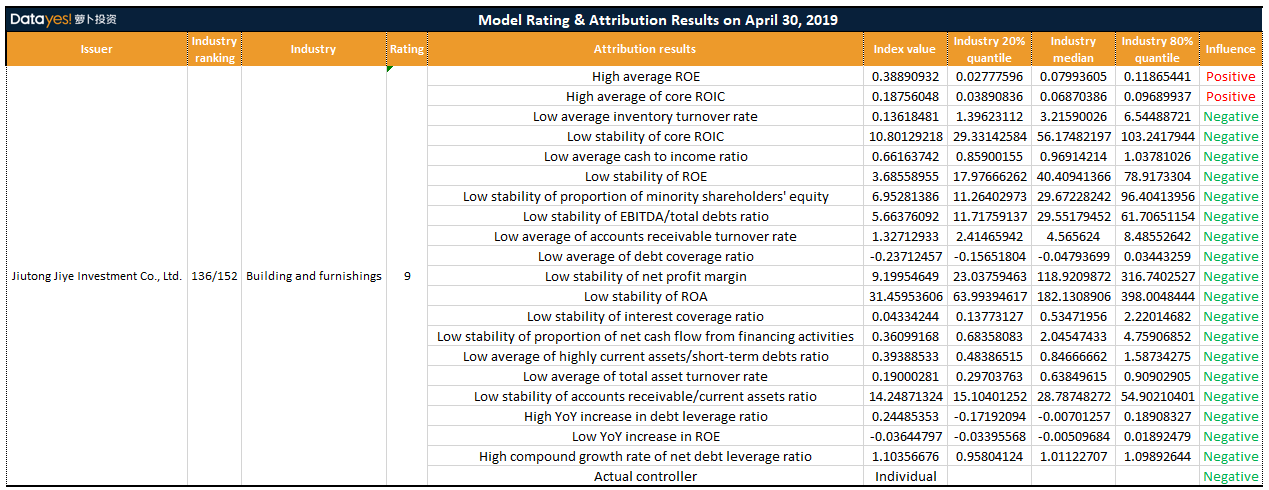

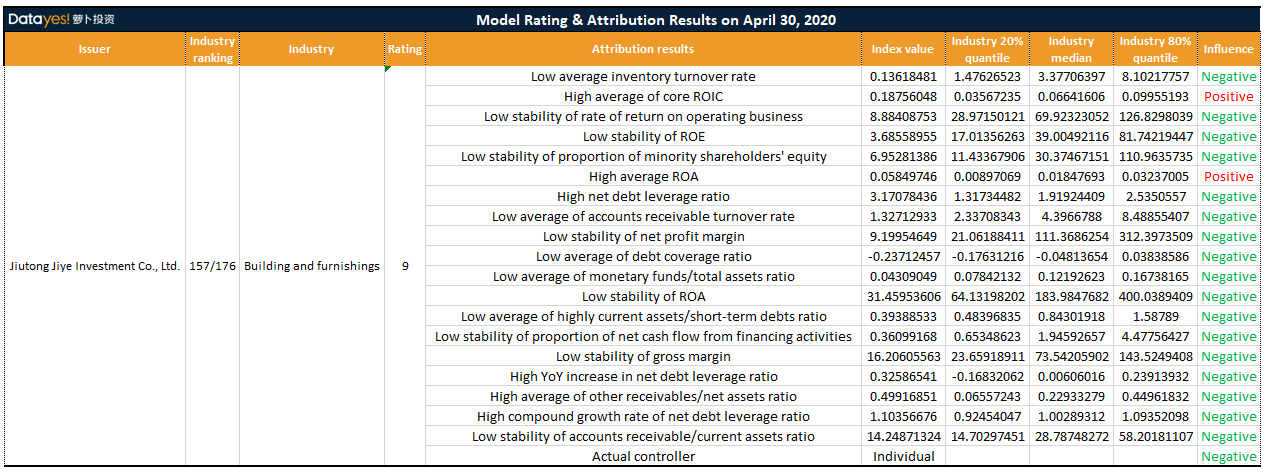

3.2.4. Jiutong Jiye

On June 1, 2021, the bond “18 Jiutong 02” issued by Jiutong Jiye Investment Co., Ltd. failed to pay the principal and interest in full as scheduled, which constituted a default. According to public information, the private placement bond “18 Jiutong 02” was issued in June 2018, with a current balance of CNY 1.4 billion, a coupon of 5.9%, and a maturity of 3 (1+1+1) years, and was due to mature on June 1 this year.

The Datayes! corporate bond rating model had already rated Jiutong Jiye at Level 9 as early as April 30, 2020, indicating that the entity had quite a high risk of default. On April 30, 2021, the model’s rating for the company was still Level 9. However, the decline in its ranking in the industry indicated a further increase in the default risk of the company. The attribution results presented by the model show that although Jiutong was still profitable, such profitability is extremely unstable, while its short-term debt service pressure is high. In addition, Jiutong’s capital structure indicators such as a high net debt leverage ratio and a low stability of the net debt leverage ratio indicated a large debt burden. In addition, there was a slow realization of the company’s assets and the actual controller is an individual, so these negative factors led to Jiutong’s late debt storm.

Figure 11 Rating & Attribution Results of Jiutong on April 30, 2019

Figure 12 Rating & Attribution Results of Jiutong on April 30, 2020

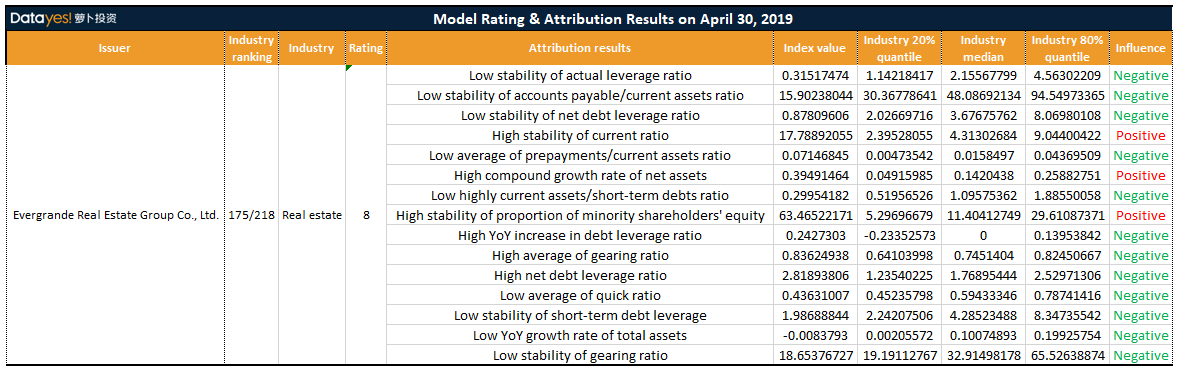

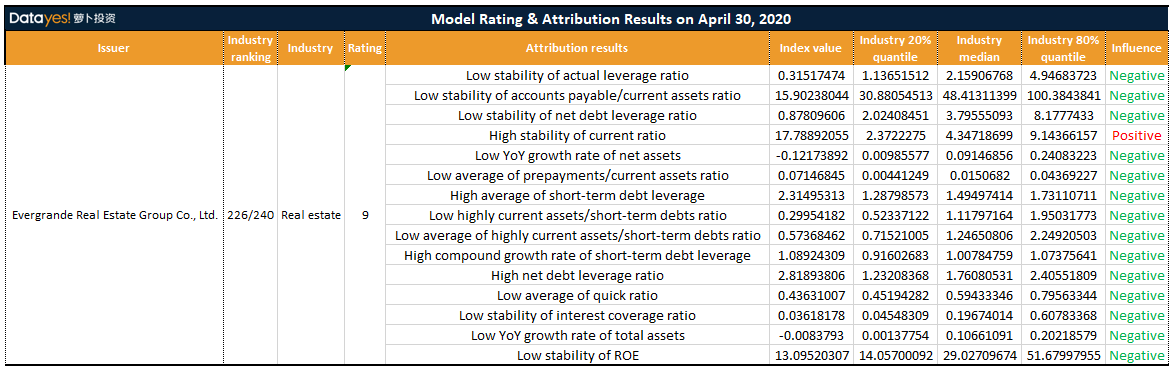

3.2.5. Evergrande Group

On September 16, 2021, Evergrande Real Estate Group Limited issued an announcement on the suspension of trading of its corporate bonds: The trading of all the existing corporate bonds of Evergrande Real Estate will be suspended for one trading day from the opening of the market on September 16, 2021 and resume from the opening of the market on September 17, 2021, and the trading method of the above-mentioned bonds will be adjusted from the date of resumption. So far, Evergrande Group has been trapped in a debt quagmire throughout 2021, and potential debt defaults have also put massive pressure on it. However, the Datayes! corporate bond rating model had revealed early signs indicating that this would be an eventful year for Evergrande.

The Datayes! model already had rated Evergrande at Level 8 as early as April 30, 2019, indicating that the entire operating situation of Evergrande Group was not promising. The model attributed Evergrande Group’s difficulty to its highly leveraged and heavily indebted operations as well as its extremely unstable leverage ratio. At the same time, Evergrande’s insufficient asset growth rate further compressed its profit margin, while there were fewer quick assets on its books. All of such signs indicated that the company was highly vulnerable to a debt crisis.

On April 30, 2020, the model further downgraded Evergrande’s rating to Level 9, indicating that the red flags that appeared in Evergrande’s previous operations had not disappeared. On the contrary, the increase in ROE instability indicated a further deterioration of the company’s profitability, while the low interest coverage ratio also indicated that Evergrande was already at high risk at that time and highly vulnerable to debt default. These above reasons also built up Evergrande’s debt repayment difficulties in 2021.

Figure 13 Rating & Attribution Results of Evergrande on April 30, 2019

Figure 14 Rating & Attribution Results of Evergrande on April 30, 2020

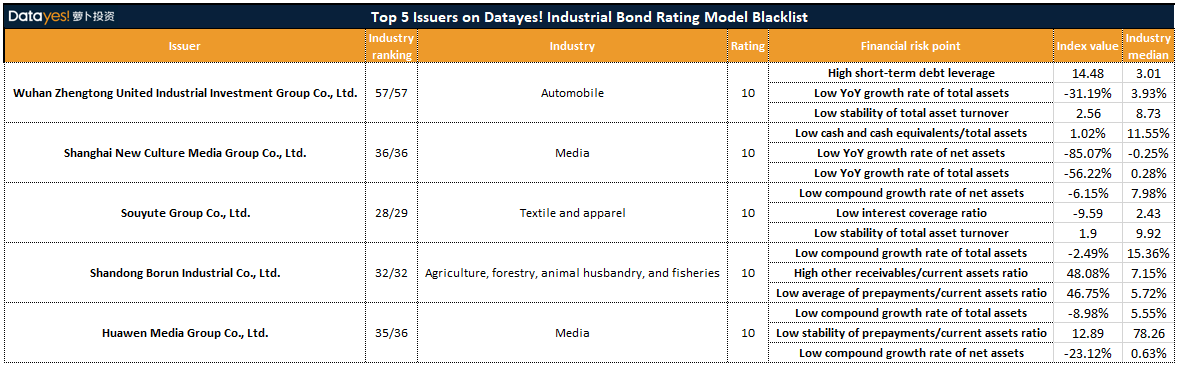

3.3. Latest forecast results of the model

As of August 30, 2021, the ratings and some attribution results of the Top 5 bond issuers ranked by default probability given by the Datayes! corporate bond rating model are shown in the table below. (Note: The bond issuers that have defaulted are excluded from this blacklist)

4. Conclusion

The Datayes! corporate bond rating model is developed based on “human-machine interaction”. The prior knowledge of human experts ensures the completeness and self-consistency of the fundamental quantitative logic, the machine learning model guarantees the accuracy of the forecast results, and the attribution of the rating results warrants the interpretability of the model.

The comparison and analysis of the forecast results verified the high accuracy and advancement of the model: It can spot more than 95% of the defaulting issuers and more than 75% of the issuers that may be troubled by negative events, and the attribution results are reasonable and effective.