Your information will be used for requirement gathering, and our sales representative may contact you regarding our product offering. The information will not be shared with any third party.

Your information will be used for requirement gathering, and our sales representative may contact you regarding our product offering. The information will not be shared with any third party.

Intelligent Asset Management Solution

A next-generation asset management system that is designed to provide scanerio-based service, and offers a one-stop asset management solution.

Pioneer of New Investment Research

Improve Institutional Service Capability

Reduce Institutional Investment Risk

Accelerate Institutional Growth

Empowering Institution Deployment Options

With over 14 categories of traditional financial data and 9 categories of alternative data, our data service meets the business requirements in fundamental and quantitative investment research, trading, risk management and other scenarios. We provide comprehensive, low-latency, and high quality financial data service to diverse customers.

Based on domain-specific vertical search capability powered by knowledge graph, we provide a one-stop search solution for data, chart, news, announcements, and research reports, that is able to comprehend a researcher’s search intension and respond with integrated results within seconds.

A real-time monitoring system that can detect fundamental and industrial changes from within our big data that is important to investment research and send notification.

Our system features editable earnings forecast model and financial knowledge graph, integrating domain expertise with artificial intelligence. It records the collective investment research process and result, facilitating the sharing and transfer of investment research knowledge.

Combining market-leading technologies on artificial intelligence, big data, and knowledge graph with quantamental investment philosophy, we help asset management institutions track investment trends, discover investment opportunities, avoid investment risks, accumulate investment knowledge, and improve investment efficiency.

Our system enhances objectivity and professionalism of fund selection in wealth management and asset allocation. It provides an integrated fund research framework, helping fund investment advisors to accurately select products, and build portfolios satisfying customer requirements.

Based on the massive data of the whole fund market, we provide hundreds of income, risk, and attribution indicators. By integrating with scoring system and performance analysis attribution model, our system provides fast and comprehensive fund selection.

Our system supports the full process of asset allocation research, from asset class research, asset allocation, and portfolio optimization to simulated portfolio tracking. In addition, it’s risk monitoring feature satisfies various regulatory requirements, which helps improve our customers’ decision-making capability.

By providing fund research, fund pool management, fund manager/company evaluation, and due diligence management, we help all members within the organization to collaborate efficiently and accumulate research report results.

Based on in-depth understanding of financial products and AI-driven market forecasts, our product provides diverse FOF solutions and enables strategists and financial advisors to better serve their customers.

Our system provides advice and information services in the full life-cycle of users’ investment, and help improve our users’ investment expertise through investor education services.

Based on the world’s leading FOF investment research capabilities and in-depth understanding of investment advisory scenarios, we provide customized asset allocation and full life-cycle management for diverse users.

An end-to-end comprehensive portfolio and risk management system that fully integrates risk analysis and portfolio management tools. The system leverages our quality market data and advanced models to detect risk, helping operation personnel to quickly adapt to changing market condition.

Our system provides various reporting features meeting regulatory requirements, as well as customizable monitoring capability for various risk monitoring scenarios.

Based on scientific risk analysis, our system supports stress test and scenario analysis, helping our customers forecast and quickly respond to changes in the market by analyzing portfolio risk under extreme scenarios.

Our system provides various reporting features meeting regulatory requirements, as well as customizable monitoring capability for various risk monitoring scenarios.

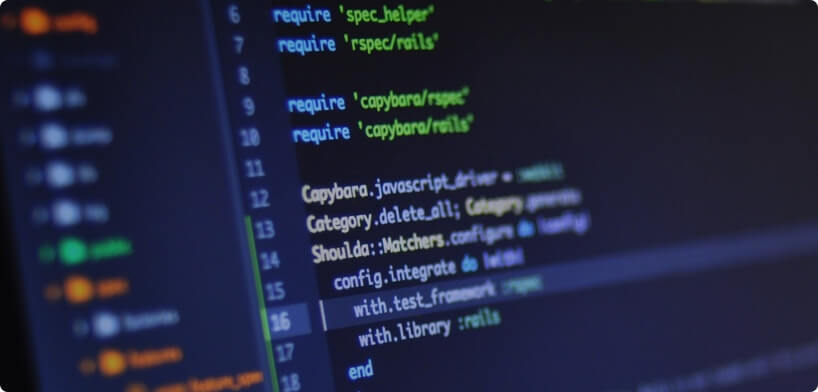

Our system integrates traditional and alternative data from diverse sources to improve factor search range and to ensure high novelty of factors, helping our customers realize exceptional returns.

Our system provides risk factor exposure analysis and revenue change monitoring, and, through portfolio optimizer feature, helps control portfolio risk and improve return-to-risk ratio.

Featuring automatic simulated multi-asset portfolio management based on multi-asset strategy, our system supports investment decision of fund manager and strategy follow-up of individual customers, helping customers meet the diversification requirement on capital allocation.

We provide alternative data, factor discovery and analysis tools, model development tools, strategy management and evaluation platform, and portfolio management and optimization system, satisfying the requirement of quantitative research life-cycle management.