Using Datayes’ Job Postings Data to Search for Alpha in Growth Stocks

2021-08-05 17:32:55

Alternative data has been attracting increasing attention in recent years, and Job Postings data in particular is gradually catching the eye of investors.

Kaiyuan Securities conducted a research study with Datayes’ Job Postings data to try and find out whether Job Postings data contain additional hidden alpha-generating information, and to try and extract excess returns from it.

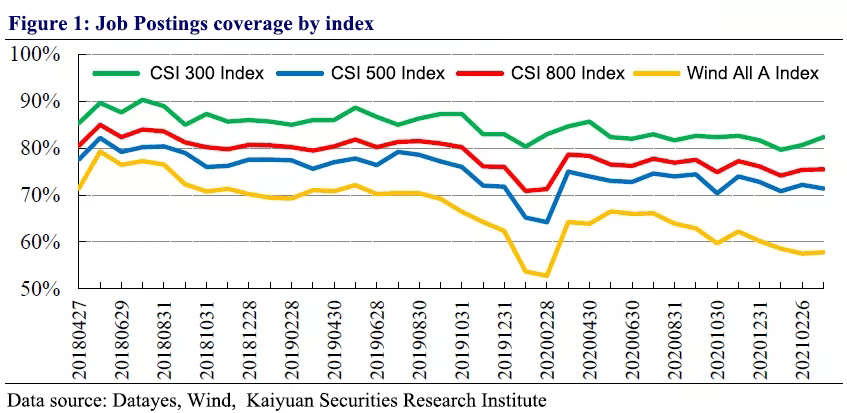

The coverage of Datayes’ Job Postings data was as follows:

The coverage of Job Postings data in the CSI 300 index was the highest at over 80%. Overall, the coverage in the CSI 500 and CSI 800 indices was similar, ranging between 70% and 80% in the past year.

Using Job Postings data on stock selection

Job postings refer to the total number of new job advertisements posted by listed companies in each month. To test the effectiveness of Job Postings data in stock selection, listed companies were sorted and grouped based on the total number of job advertisements posted at the end of each month. As the effective sample size of the broad-based index was relatively small compared to the whole market, Kaiyuan Securities carried out a test based on three groups in the broad-based index, and a test based on five groups in the All-A stock pool. The transaction fee was set at 30 basis points for both buy and sell, and market value and industry neutralizations were carried out on Job Postings data before backtesting.

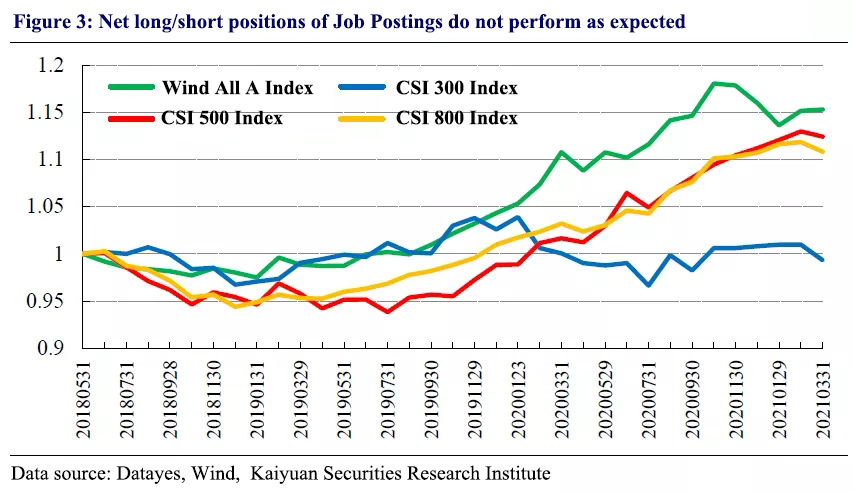

The empirical results manifest that Job Postings data performed better in the CSI 500 and CSI 800 indices than in the CSI 300 index. Within the test range, Job Postings data did not provide additional valuable information in the CSI 300 index. Using the CSI 300 and CSI 500 indices as proxy indicators of value and growth stocks, Job Postings data performed better within growth stocks. From the long/short yield curve of the Wind All-A index, Job Postings data showed long/short returns to be negative in the first year of the test range, indicating the possibility of the data being ineffective. In addition, the net value curve also showed characteristics such as relatively large fluctuations, and insufficient absolute returns, etc. Therefore, directly using Job Postings data in stock selection would not be ideal.

Job Postings data more effective on growth stocks

When a company is in its growth stage of the industry life cycle or in a stage of rapid development, an indirect result is that the company would show continuous demands for its recruitment needs. Deducing from the above, job postings data should perform better in high-growth industries, but was this the actual case?

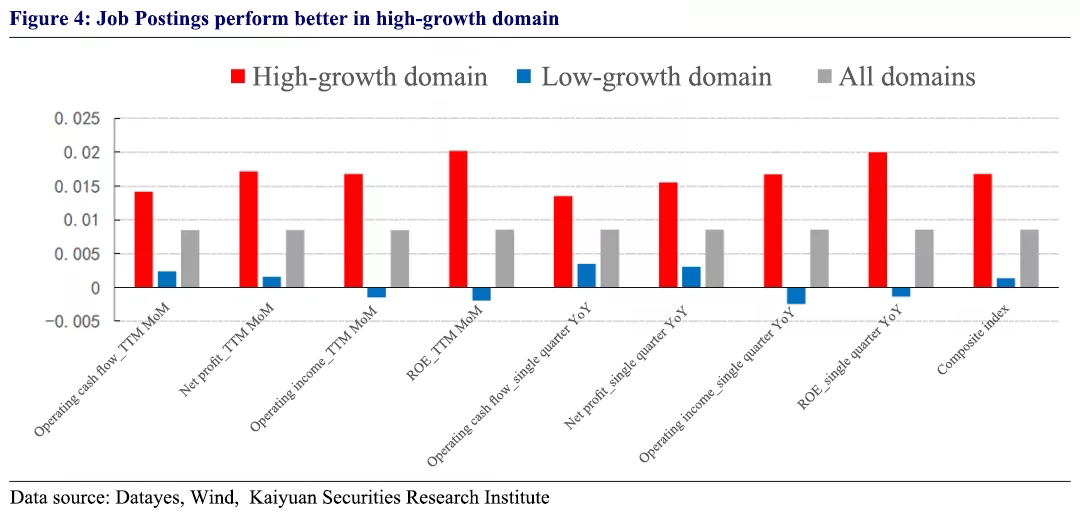

To test this conjecture, Kaiyuan Securities selected common indicators measuring growth in the market and conducted a domain-based study on Job Postings. The stock pool was divided into high and low domains based on growth, and testing was conducted in groups in the different domains. Lastly, all indicators showing growth were standardized and weighted to derive a composite growth factor. The stock pool was then divided into high and low domains based on the composite growth factor, and tests were carried out on Job Postings in groups in the different domains.

It can be seen that regardless of which growth indicator was used for domain division, the IC value of Job Postings in the high-growth domain was higher than the IC value of Job Postings in the low-growth domain. Looking at the sub-indices, based on the ROE index, a stock selection strategy based on Job Postings performed the best, with the IC values in the high and low domains showing positive and negative in contrast.

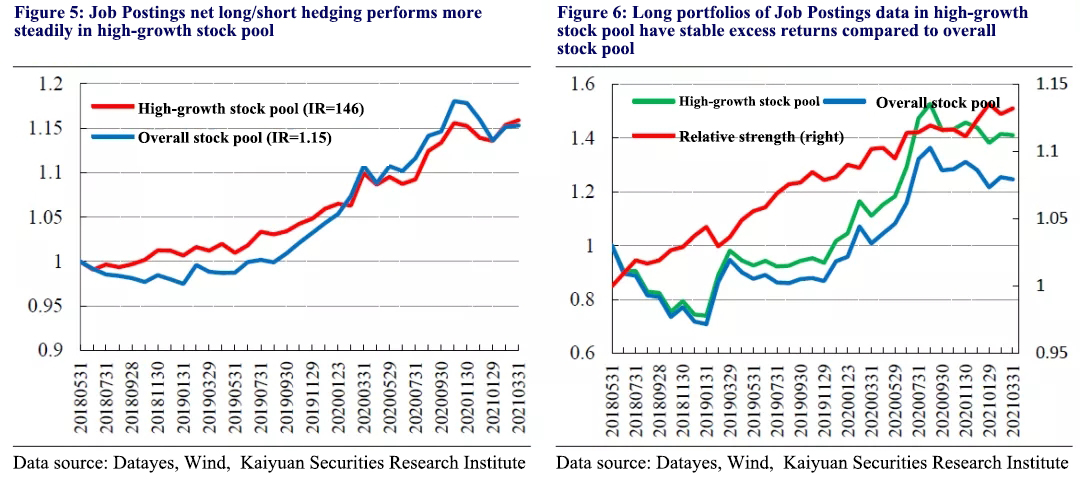

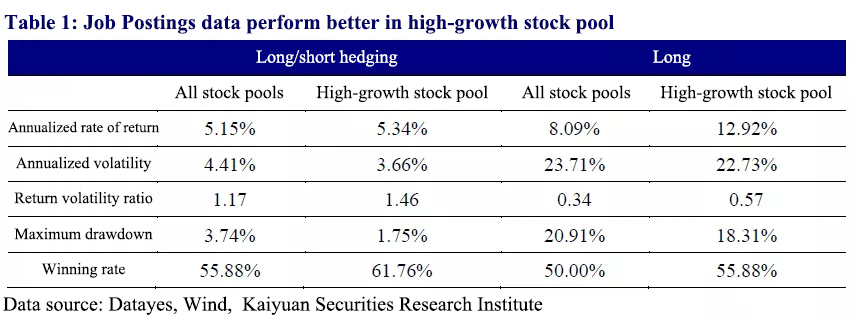

To minimize selection bias of proxy indicators, Kaiyuan Securities used a composite growth indicator to divide the stock pool into high and low domains, and observed the performance of Job Postings within the high-growth stock pool. From the net value performance of long/short hedging strategy, the stability of the long/short hedge curve improved rather significantly in the high-growth stock pool, with the IR value increasing from 1.15 in the all-stock pool to 1.46 in the high-growth stock pool. Based on the relative strength curve of net long positions, the long positions in the high-growth stock pool steadily outperformed the long positions in the all-stock pool, with an excess return of approximately 15% during the test period. The above result has proven the conjecture that when a high-growth company increases its recruitment, its stock price would be likely to perform better in the future.

Table 1 shows the performance of long/short hedging and pure long-position strategies of Job Postings data in different domains (all domains vs. high-growth domain). In the high-growth domain, after market value and industry neutralizations, the annualized rate of return of pure long-position strategies increased by about 5% compared to the overall stock pool. The return-to-volatility ratio also improved significantly, and the drawdown also decreased to an extent, but the winning rate was relatively low across all domains.

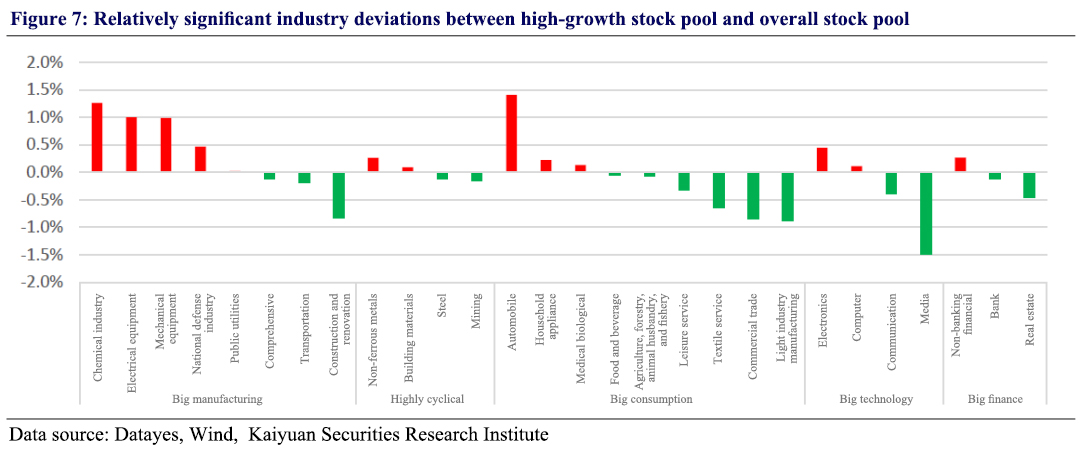

To present the coverage of Job Postings data more intuitively across various industries in the high-growth domain, Kaiyuan Securities calculated the cross-sectional industry deviation of the composite index between the high-growth domain and the overall domain. There was a high level of Job Postings data coverage in the chemical, mechanical equipment, and electrical equipment industries in the big manufacturing sector. The Job Postings data coverage of the automobile industry in the big consumption sector increased significantly, outshining the other industries in the sector; this is becoming all the more apparent with major Internet giants all tapping into the automobile manufacturing market in recent years. The media sector in big technology has shown a continuous downward trend in recent years, reflected in the significant decline in the Job Postings data coverage. As a result of ongoing policy regulation in recent years, the Job Postings data coverage of the real estate industry in the big finance sector has also declined somewhat.

Just as a powerful gust of wind might start off as a gentle breeze or turbulent waves might start off as small ripples, while the recruitments of a single company in a particular industry might have little impact on the market, when multiple companies in a particular industry all begin to post recruitment information, this may well be a forward-looking indicator of an upward trend in the life cycle of the industry.