How to pinpoint China A-share industry cycle?

2021-08-27 16:19:30

Recently, the China A-shares market has continuously shown extreme market condition, where the strong remains strong and the weak remains weak. Stocks with strong performance, led by non-ferrous metals and coal, have set off successive batches of limit-up circuit breakers, with many stocks setting new price records. Stocks with weak performance, mainly brewing and pharmaceuticals, continue to fall, with many stocks successively setting new periodic lows. The extreme divergence of the market has generated a large gap between the winning and losing side. Accurate grasp of the industry cycle has become the key to investment success.

Accurate Industry Selection Is Key

Judging from the rising trend of hot sectors of the year, they have in common a dual drive of favorable policies and improvement on industry profitability. In particular, cyclical stocks such as non-ferrous metal, coal, and steel, seem to have return to their past glories in 2007.

Taking non-ferrous metal as an example, the latest statistics from Datayes! shows that the recent growth of industrial metals such as copper, aluminum, lead, and zinc has accelerated significantly. This is reflected in the secondary market in rising stock prices of industry leaders such as Aluminum Corporation of China, Huludao Zinc Industry Co Ltd, Yunnan Copper Company Limited, etc.

In rare metals, rare earth and lithium sectors also show steep rise.

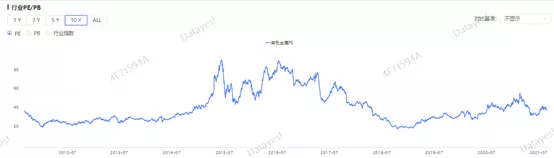

Again taking non-ferrous metal as an example to look at fundamental valuation, the current PE of the industry is about 40, which is relatively low in the past 10 years.

The mining industry, represented by coal, currently has a PE of only about 13, an absolute low in 10 years.

It can be seen that the stock price performance in the secondary market has not deviated from industry fundamental. A more accurate understanding is that the elasticity in these cyclical industries determine the violent fluctuations of the stock prices.

How can industry research be one step ahead?

Major opportunities in stock market investment can evolve into a search of industry growth period and a buy-and-hold strategy during this period. As such, refined analysis of industry prosperities is of top priority.

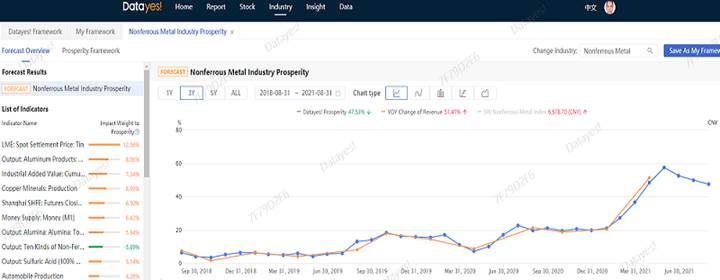

The industry prosperity forecast feature of Datayes! leverages the wisdom in Kelly’s criterion to comprehensively describe price-performance of industry investment using multiple dimensions such as industry prosperity, market trend intensity, valuation, and congestion.

Industry prosperity reflects the dynamic changes of industry fundamentals in real-time. Market trend intensity reflects the market’s feedback on changes in industry fundamental. A solid industry fundamental is the basis of investment return. Combined with the market’s recognition of industry fundamentals, the two together determine the winning rate of investing in an industry.

Again taking non-ferrous metals as an example, our forecast on industry prosperity accurately matches the actual, providing an important early signal for investment.

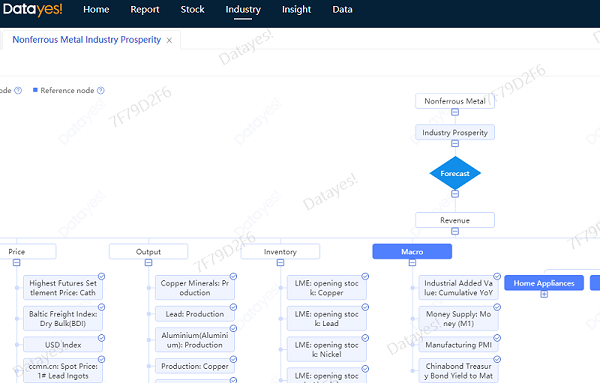

The forecast framework (partial) on non-ferrous metal. For the full framework, please see Datayes! platform.

Datayes! helps your industry research stay one step ahead and allows you to quickly react to marginal changes in industry fundamentals.